Pitney Bowes Inc. (NYSE:PBI), a global shipping and mailing company that provides technology, logistics, and financial services, today released new consumer data from its BOXpoll survey revealing key peak season trends and insights to help retailers prepare to meet consumer preferences and demand. The findings reveal that despite conflicting economic indicators, consumers say they’ll buy online more or the same as last year—supported by trends in growing consumer spending and credit card balances this year.

“While U.S. consumers grapple with economic challenges including the lingering impacts of inflation, their discretionary spending—particularly online—appears to defy gravity headed into the holidays,” said Vijay Ramachandran, VP of GTM (Go-to-Market) Enablement + Experience at Pitney Bowes. “Online sales so far this year are up more than 7% versus 2022, even though online prices have been on a deflationary trend for more than a year.”

American consumers are holding up better than expected.

According to the latest BOXpoll survey conducted in September:

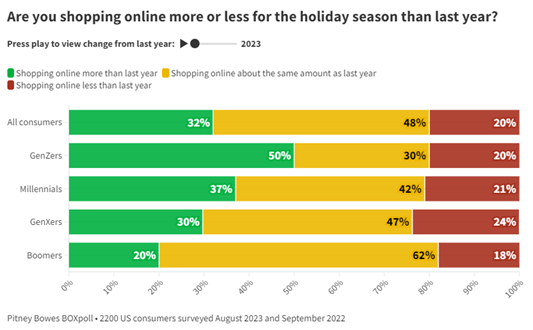

- 32% of consumers plan to shop online more than last year, 48% plan to spend the same amount, and only 20% plan to spend less—figures which are consistent with last year’s findings.

- Among the 20% of consumers planning to spend less online, slightly more than half are cutting back on overall (i.e., non-holiday) spending—a significant reduction from the 71% who expected to be cutting back last year.

- Gen Z and Millennials are even less likely to curtail online spending, with 22% and 18% year-over-year declines, respectively, among those age groups saying they were to say they plan to spend less online versus last year.

“These survey results reflect what we’re seeing in the market and with our own clients: Consumers are having a hard time letting go of COVID-era shopping habits—and rather than curtail overall spending, they’re ‘trading down’ to lower-priced brands and lower-value product categories as they seek to make their budgets go farther in reaction to perceived inflation. Retailer earnings from Q2 saw mid-priced and discount brands reporting stellar quarterly results at the expense of more premium brands and department stores. We know from consulting with our clients that mid-price apparel, as well as accessories and beauty brands, are optimistic about the holiday season, while sporting goods and home décor brands are approaching peak more cautiously,” added Ramachandran.

Consumers will do what it takes to earn free shipping.

- To further examine how consumer shopping behaviors have evolved in recent months, Pitney Bowes asked BOXpoll survey respondents if they have noticed it has become harder to quality for free shipping, and 39% agreed.

- In addition, 42% of consumers already expect it will become harder to qualify for free shipping this holiday season compared to last year. The results also revealed consumers are most likely to either add more items to their cart to qualify for free shipping (44%) or try to find the same item with a different online brand that will offer free shipping (37%).

Pitney Bowes’ data also shows that these trends in consumer behavior are coming amidst retailer challenges including difficulties with comparing carrier cost structures, differentiating customer tracking experiences, managing returns fraud, and finding cross-border shipping partners who can handle both compliance and logistics.