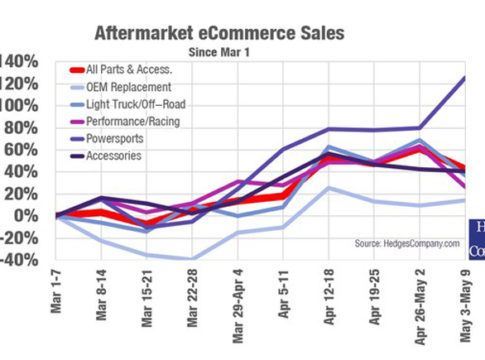

Parts and accessories eCommerce is up 42% since the first week of March 2020, according to Hedges & Company data.

Hedges & Company, a digital marketing agency serving the automotive aftermarket, OEM parts and powersports industries, is tracking weekly eCommerce activity in the automotive aftermarket, OEM parts and powersports aftermarket industries. The company analyzed nearly 12 million user sessions and online purchases from parts and accessory websites in the US and Canada. The analysis includes retailer websites as well as manufacturer websites selling direct to consumer (DTC).

The analysis compares weekly online sales starting March 1-7, before the coronavirus pandemic forced wide-spread shutdowns of retail businesses. The latest eCommerce comparison covers the week of May 3-11, the ninth week of the analysis.

Hedges & Company broke down online sales into five market segments, including OEM replacement parts, light truck and off-road parts and accessories, performance and racing parts, aftermarket accessories, and powersports parts and accessories. Here are sales increases for the week of May 3-9 compared to the week of March 1-7:

- Overall aftermarket eCommerce sales including automotive, light truck and powersports: up 42%.

- OEM replacement parts sales: Up 14%.

- Light truck and off-road parts sales: Up 37%.

- Performance/racing parts sales: Up 26%.

- Powersports parts and accessories: Up 126%.

- Automotive aftermarket accessories: Up 41%.

Aftermarket eCommerce websites are showing an average 11% improvement in website conversion rates for the first ten days of May, compared to the first 10 days of March.

Average session duration was down 1.4% in May and pages per session was up only slightly, at 1%. Both metrics suggest online shoppers had an idea of what they wanted to buy when visiting a website. The number of visits to aftermarket websites by new visitors in May was up nearly 6%.

Hedges & Company is publishing regular updates as a service to the parts and accessories industry. Other eCommerce companies in the aftermarket are invited to share in the analysis by contacting Hedges & Company.