Key takeaways

- Amid Amazon Prime Day and other massive retail promotional events, online sales increased 50% year over year, during Oct. 11-17, 2020.

- Traditional and online-only mass merchants will likely win this holiday season; throughout the first three weeks of October 2020 consumer spending at these stores was up between 10% and 30%.

- During the October digital promotional events, retailers received a significant spending bump due to likely purchases of toys/games, electronics and sporting goods, and other items, signaling an early start for these traditional holiday categories.

Why this matters

It is no secret that COVID-19 is changing how and where consumers will shop. This year, October unofficially rang in the holiday season as many major retailers launched massive online promotions, several of which were shifted from the summer timeframe due to COVID-19. To garner insights into how COVID-19 is impacting holiday spending, Deloitte’s InSightIQ team analyzed consumer spending data from the first three weeks of October to better understand consumer behavior. Deloitte’s newest report, “Retail Insights for Holiday 2020: October Pulse” helps shine light on how consumers are making holiday purchases and what that means for retailers over the course of the next six weeks.

Consumers are shopping at home this holiday season

According to the “2020 Deloitte Holiday Retail Survey: Reimagining Traditions,” 61% of consumers plan to begin shopping before Thanksgiving. Typically, those who start their holiday shopping before Thanksgiving plan to spend more, with an expected average spend of $1,537 per household.

The InSightIQ analysis shows that many consumers are getting a head start this holiday season, as seen during the third week of October, where major promotional events, including Prime Day, resulted in a 6% year-over-year spending increase, across in-store and online, for the sector.

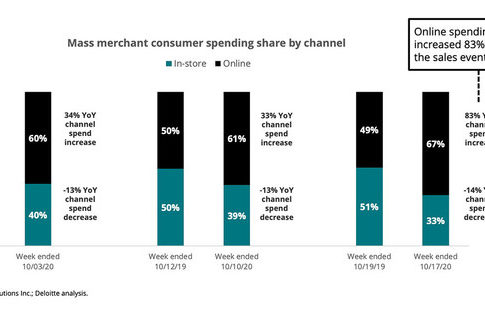

The pandemic has undoubtedly led to a dramatic increase in online shopping. Year over year, online sales during the first and second week of October were up 25% and 24%, respectively. Prime Day and other promotions further accelerated this trend; online sales catapulted during Prime Week, recording a 50% increase in online sales, year over year.

In fact, InSightIQ data shows that among online and traditional mass merchants, online spending increased 83% year over year during Prime Week. Not only did spending increase, but so did the number of people visiting retailers’ digital sites. During the third week in October, visits increased 63% year over year, and the number of unique visitors increased 47%.

“The InSightIQ analysis confirms that retailers’ strategy to accelerate holiday shopping was successful. During Prime Week, major retailers’ online promotions drove the share of digital shopping even higher and helped jump-start the shopping season this year as shoppers purchased items traditionally associated with the holiday season, including toys, games, electronics and sporting goods,” said

Jeff Simpson, leader, InSightIQ, and principal, Deloitte Consulting LLP.

No over the river and through the woods travel this year

This holiday season, consumers are cutting back on travel and other outside of the home holiday experiences and plan on celebrating the season with loved ones at home.

- Deloitte’s Holiday Retail Survey found that spending on socializing away from home and travel is expected to decline 34% year over year, to $260 per household.

- Between Oct. 1 and 17, spending on travel was down between 56% and 58% year over year, according to InSightIQ data.

- Likewise, Deloitte’s most recent “State of the Global Consumer Tracker” found that as of early October, consumers were still feeling anxious about travel; only 29% of U.S. consumers felt safe taking a flight, 41% felt safe staying in a hotel and nearly one-third of consumers (30%) planned to scale back travel expenses in the month of October.

Shoppers can easily check off wish list items from retailers that offer essentials, as well as gifts

Traditional and online-only mass merchants will likely win this holiday season as they are a one-stop-shop for many gift buyers.

- Mass merchants have consistently seen spending increases since the COVID-19 pandemic began in March; they have been able to remain open, meet broad consumer needs, and deliver omni-channel shopping experiences. During the first two weeks of October, spending was up 10% year-over-year.

- Additionally, as consumers spend more time at home and tackle DIY projects, home improvement stores saw a 19% jump in sales, year over year, during the week of Oct. 17.

- Toys and games, electronics and sporting goods retailers also received a significant bump during the promotional events period, signaling an early start for these traditional holiday categories.

“Not only are this year’s consumers spending more time at home, they are shopping from home as well. As the Prime week insights show, consumers continue to value savings and convenience. Additionally, consumers are cutting back on the numbers of stores they visit, both virtually or in-person, making mass merchants the most appealing holiday shop. To win this holiday season, retailers should offer a variety of goods at an exceptional value, as well as discounted or free shipping, free return shipping and services like buy online and pick-up in store (BOPIS) to appeal to a range of shoppers,” said Rod Sides, vice chairman, Deloitte LLP, and U.S. retail, wholesale and distribution leader.