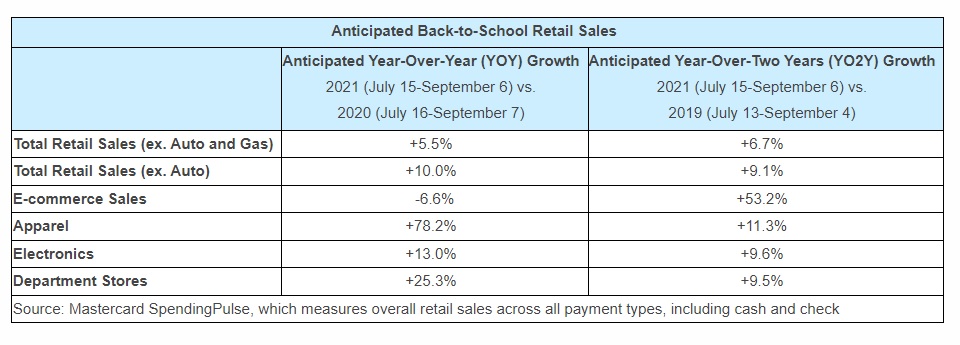

As students wrap up the current school year, retailers – and parents – are already preparing for a robust back-to-school shopping season as more kids head back into the classroom. According to Mastercard SpendingPulse™, which measures in-store and online retail sales across all forms of payment, U.S. retail sales are expected to grow 5.5%* excluding automotive and gas during the critical July 15 through September 6 back-to-school period compared to 2020. Compared to 2019, sales are expected to grow 6.7%.

“Back to school has always been a prime season for retailers. This year, the broader reopening brings an exciting wave of optimism as children prepare for another school year, and the grown-ups in their lives approach a similar ‘return to office’ scenario,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “This back-to-school season will be defined by choice as online sales remain robust, brick and mortar browsing regains momentum and strong promotions help retailers compete for shoppers’ wallets.”

Sector-Level Back-to-School Trends:

As the broader U.S. reopening occurs and consumers return to brick and mortar, we anticipate e-commerce sales will ease slightly compared to last year (-6.6%) but will remain up a significant amount (+53.2%) when compared to 2019. In terms of what consumers are buying this back-to-school season, we anticipate the following retail trends:

- Apparel Refresh: While athleisure was the fashion statement of 2020, this year brings the diversification of the wardrobe as in-person schooling, reunions and other events drive consumers to make their social debuts in style. Apparel is expected to grow 78.2% YOY / 11.3% YO2Y.

- Department Store Shopping Returns: Department Stores, outdoor shopping centers and malls offer a fresh change of scenery for shoppers. We forecast a 25.3% YOY / 9.5% YO2Y increase in the Department Store sector as they rebound from last year’s dip in foot traffic. Buy online, pick-up in store as well as technologies such as contactless will remain important as consumers continue to seek low-contact experiences.

- Tech Upgrade: If we learned one thing this past year, it’s that technology keeps us connected. With many states and schools determining the virtual/in-person cadence, we anticipate Electronics will be up 13.0% YOY / 9.6% YO2Y.

Building on Ongoing Retail Momentum:

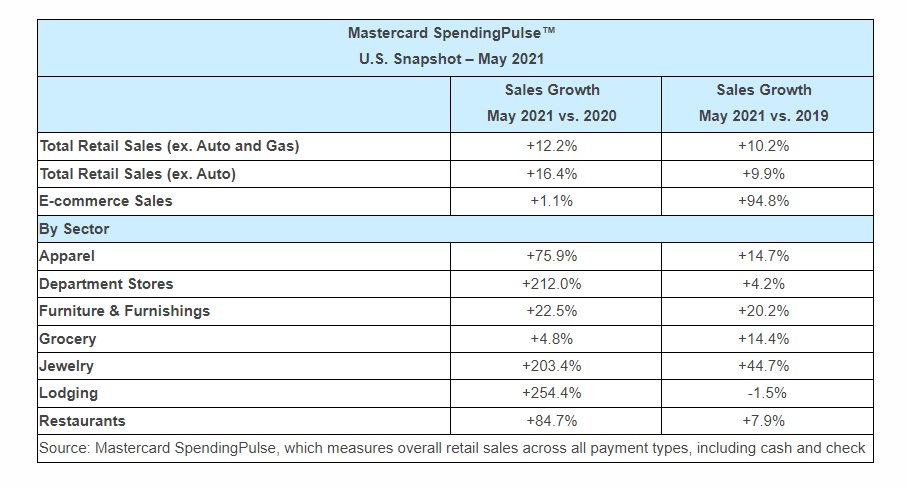

The anticipated back-to-school sales growth is a continuation of ongoing retail sales momentum, with May marking the eighth consecutive month of Total Retail Sales growth*. According to Mastercard SpendingPulse, U.S. retail sales excluding automotive and gasoline, increased 12.2% year-over-year in May, and 10.2% compared to May 2019. Online sales in May grew 1.1% and 94.8% respectively, compared to the same periods.

*excluding auto and gas sales