In the wake of the coronavirus, new research from experience analytics platform provider Contentsquare has revealed the impact of the virus on ecommerce and digital consumer behavior. The company has launched a Coronavirus eCommerce Impact Hub to provide updated insights throughout the crisis.

Calling on real-world data from over 21 billion page views across over 1,400 sites, the research identifies the sectors most impacted by the coronavirus and resulting self-isolation.

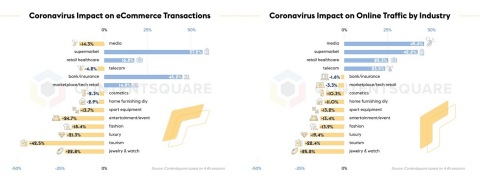

- Visits to sites selling jewelry (-25%), travel (-22%), luxury goods (-19%) and clothing (-14%) have all dropped since the start of the crisis.

- Traffic to sites selling sport equipment has also fallen by 13% as consumers avoid outdoor activities.

- Event bookings and theatre sites have seen a drop off in traffic of 13% over this period.

- As well as a fall in traffic, many sites have also lost sales, with a 47% decline in transactions across leading tourism sites, and a 25% drop off for event bookings.

While many industries are suffering, some sites have actually seen a rise in both web traffic and sales.

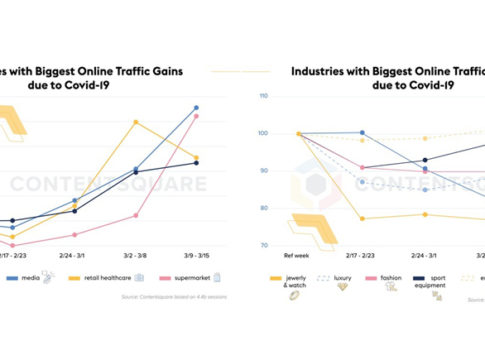

- The biggest traffic spikes were recorded across Media (+46%), Supermarkets (+42%), Healthcare (+24%) and Telecom (+24%). Media and Supermarkets experienced a strong acceleration during the last week (+46% / +42%) following strict isolation measures

- Healthcare, while up overall, experienced a drop in traffic last week (-10%) versus the prior week, following 2 weeks of increases.

- Supermarkets experienced the biggest increase in number transactions (+52%) since the onset of the crisis

- As consumers self isolate, traffic on media sites is surging, but this is yet to translate into new subscriptions or purchases.

Commenting on the new data, Aimee Stone Munsell, CMO at Contentsquare said, “These purchases clearly correspond to Maslow’s famous ‘hierarchy of human needs’. To satisfy needs at the base of the pyramid, consumers are stocking up on vital food and health products and other daily necessities. In contrast, more self-indulgent purchases — which fall into the top of Maslow’s needs — are dropping significantly.

“When managing a crisis on the scale of Covid-19, these real-world insights can be invaluable for brands. The ability to identify behavioral shopping trends in real-time allows retailers to respond with changes to stock, navigation and on-site promotions in order to help consumers find the products they need to with minimum disruption.”

Ecommerce and digital behavior data relating to the crisis will continue to be regularly updated at https://contentsquare.com/coronavirus-ecommerce/