Key takeaways

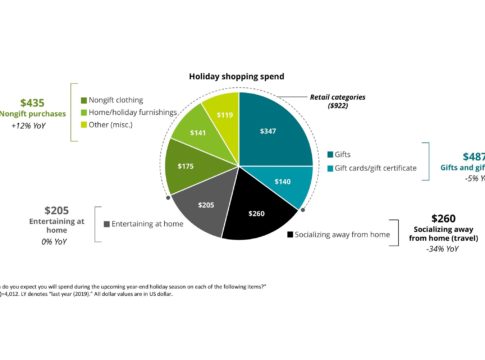

- Amid continued COVID-19 anxiety, shoppers plan to spend cautiously this holiday season, averaging $1,387 per household, down 7% from 2019.

- Spending is expected to shift to non-gift purchases for celebrations at home ($435, up 12%), and socializing away from home and travel is expected to decline 34% year over year.

- Nearly 51% of holiday shoppers feel anxious about shopping in-store, and 64% of the holiday budget is expected to be spent online.

- Contactless shopping experiences are in great demand with 73% of consumers planning to have items delivered using traditional delivery players, and the use of curbside pickup options (27%) is expected to more than double from last year.

- New shopping behavior favors efficiency as the average shopping window is expected to be 1.5 weeks shorter this year.

Why this matters

Despite its disruptive impact on consumer behavior and retail spending throughout the year, COVID-19 is not cancelling the holiday shopping season, although it is changing how and where consumers will shop. For the past 35 years, Deloitte has been tracking the holiday shopping period, examining consumer behavior and what retailers can expect from shoppers as they tackle their holiday shopping. This year’s report, “2020 Holiday Survey: Reimagining Traditions,” surveyed 4,012 consumers nationwide. Conducted online Sept. 9-15, it provides key insights into how COVID-19 is impacting the holiday season.

Home for the holidays takes on new meaning as consumers shift spending

While the majority of consumers (71%) are in a similar or better financial situation than last year, nearly 1 in 3 (29%) say that their household’s financial situation is worse year over year. Given the financial uncertainty, 38% of consumers say they plan to spend less on the holidays, a level not seen since the Great Recession.

As consumers cut back on travel and other holiday experiences, they’re planning on celebrating the season with loved ones at home, and focusing their spending more on non-gift items like home, holiday furnishings and non-gift apparel.

- Consumers are expected to spend $435 per household on non-gift purchases this holiday season, accounting for nearly a third of household holiday spending and representing a 12% increase from last year.

- Travel and socializing away from home is expected to decline 34% year over year, to $260 per household.

- Spending on gifts and gift cards is forecast to be $487 per household, a decline of 5% since 2019.

Contactless gains importance as consumers seek safety and convenience

Ongoing anxiety spurred by COVID-19 continues to compound consumers’ shift from in-store shopping to contactless options. More than half of consumers (51%) are anxious about shopping in-store during the holiday season due to COVID-19, and furthermore, 49% won’t return to pre-COVID shopping behavior until a vaccine is developed.

- Among those who plan to shop predominantly online, nearly two-thirds of consumers will shop online to avoid crowds (65%), because they prefer the convenience of shopping at home (64%), and want to take advantage of free shipping or delivery options (60%).

- More than two-thirds (69%) of consumers noted that they prefer shopping at a store closer to their home, and 64% of shopping budget will be spent online during the holidays.

- As consumers seek out safe and convenient options, 35% of shoppers indicated preference for buy online and pick-up in store (BOPIS), and the use of curbside pick-up (27%), which is expected to more than double from last year.

- Free return shipping is expected to be in high demand, as 70% of consumers will prefer a retailer that offers this option to make product returns most convenient.

- While safety and convenience are important, a “great deal” continues to win the day, with 61% of consumers noting its relevance in selecting a retailer.

Consumers plan to shop fewer days this holiday season

Consumers plan to complete their holiday shopping in about 5.9 weeks, which is 1.5 weeks shorter than prior years, as they plan to avoid crowds, shop closer to home, shift purchases online and maintain flexibility in their personal budgets.

- Sixty-one percent of consumers plan to begin shopping before Thanksgiving, with an expected average spend of $1,537 per household.

- Thirty-nine percent of consumers plan to begin shopping on Thanksgiving or later, with an expected average spend of $1,149 per household.

- Moreover, consumers who plan to shop on major event days plan to spend more than the average shopper. And, consumers of all age groups are likely to rely more on Cyber Monday (29%) than Black Friday (24%).

Consumers hang an extra stocking for a pet — and themselves

While gift cards (48%) and clothing (43%) are among the top gift items this holiday season, more than 30% of holiday budget will be on non-gift items.

- As consumers look for items to purchase for themselves, 45% will wait for holiday sales to buy big-ticket items for the household.

- Consumers plan to stay close to home and indulge on beverages (33%) and food items (30%).

- As COVID-19 has motivated families to add a pet to the household, half of the consumers (50%) plan to spend an average of $90 on pet food and supplies this holiday season.

- Pet stores (49%) are the most preferred retailer for pet purchases, followed by online merchants (17%) and mass merchants (15%).