Key takeaways

- Over two-thirds (68%) of consumers surveyed are willing to pay a premium for fresh food, up seven percentage points year over year, even as price continues to be the main consideration for fresh food purchases.

- At least 80% of consumers and grocers surveyed think food suppliers have raised prices more than necessary to increase their profits.

- Surveyed consumers believe in the health benefits of fresh food, as 83% think it minimizes the risk of chronic health conditions and disease. The same number of consumers believe fresh food also contributes to weight loss.

- When it comes to knowing their food is safe, trust in one’s grocery store (37%) is more important to consumers surveyed than trust in food brands (30%) or government regulators (24%).

- The fresh department is where ESG (environmental, social, and governance) claims matter the most, according to both consumers (30%) and grocers (36%) surveyed.

Why this matters

As high prices at the grocery store begin to moderate, many consumers do not just see the value in fresh food — they are willing to pay a premium for it. However, grocery retailers and consumers are not always on the same page when it comes to fresh food. In the new report, “Fresh Food at the Intersection of Trust and Transparency,” Deloitte examines the current state of the fresh food industry and how grocers can adapt to consumers’ shifting preferences to help drive new opportunities. In addition, the report discusses the importance of transparency in the sourcing of fresh food, as the Food Safety Modernization Act (FSMA) Section 204 took effect earlier this year and requires the FDA to set traceability requirements for many categories of fresh food.

The importance of fresh food continues to heat up

Fresh food is the most important department for surveyed consumers and grocers alike. Fresh food makes consumers happy — and they are willing to pay more for it. However, when it comes to price, consumers and grocers agree that food suppliers have raised prices more than needed.

- Fresh food matters: 9 in 10 consumers surveyed say fresh food makes them happy, and the same number of respondents (91%) believe a wholesome diet includes fresh food. Further, two-thirds (64%) of grocery retail executives say fresh food is the most strategically important department for their company’s sales growth plan over the next 12-36 months.

- Despite inflation, two-thirds (68%) of consumers surveyed are willing to pay a premium for the best fresh food, up seven percentage points year over year and similar to 2021 levels. On average, these consumers are willing to pay 28% more for fresh food than frozen, canned, or processed alternatives.

- A majority of consumers surveyed (80%) believe food prices have gone up more than needed, an increase of seven percentage points year-over-year. Similarly, when asked about food suppliers, a combined 85% of grocery retail executives surveyed said “several” or “most of them” were raising prices more than needed for the purpose of increasing profits. Only 10% of the grocers surveyed said their food suppliers were raising prices to keep up with rising costs.

- Relative to consumer survey responses, grocers appear to overestimate the importance consumers place in the purchase drivers of organic (+47 percentage points), locally grown/sourced (+33 percentage points), non-GMO (+31 percentage points), and environmental sustainability (+27 percentage points).

- A majority of consumers value fresh for health (86%), convenience (84%) and preserving freshness and reducing food waste (77%).

- Consumers increasingly say they actively seek foods that offer nutrition profiles personalized to their needs (8 in 10 consumers in 2023, up three percentage points year-over-year and up 18 points from 2021).

“As price continues to be at the top of everyone’s grocery list, the health and wellness benefits of fresh food are clear. However, the industry may be overestimating the importance of other purchase drivers. Understanding consumer behavior and preferences when it comes to organic, locally grown and sustainably sourced fresh food can help grocers differentiate themselves from the competition, not just on price, but as a trusted source of information,” notes Daniel Edsall, global grocer leader, and principal, Deloitte Consulting LLP.

How grocers can stock the aisles with trust

Grocers rank highest among retail formats for trust, according to Deloitte’s HX TrustID™ assessment. In addition, Deloitte’s recent report on “The Future of Grocery Retail” underscores how personalized experiences, embracing responsibility, or using fresh food as medicine all require high levels of consumer trust to be realized.

- Trust in one’s grocery store (37%) is more important to consumers surveyed than trust in food brands (30%) or government regulators (24%).

- Trust can help unlock food as medicine: Over one-third (38%) of consumers are willing to share some of their personal health information with their grocer to get personalized food recommendations, and 46% would likely use a grocer’s app to make healthier food choices. At the same time, 8 in 10 grocery retailers are investing in digital functionality for this reason.

- At least two out of three consumers surveyed think their grocer’s marketing and other communications are generally accurate and honest, fees and costs are clear and upfront, and they clearly communicate about their products. Grocers can further build their trust with consumers by being more transparent, specifically when it comes to providing information about how they make and spend money, their community and environmental impact, and how and why data is shared.

Fresh food can fulfill the appetite for ESG change

ESG is expected to have an impact on the growth of the fresh food category, as some consumers place a premium on authentic and defendable sustainable food claims and knowing where their fresh food is sourced, further underscoring the importance of trust and transparency.

- The fresh department is where ESG claims matter the most, according to both consumers (30%) and grocers (36%).

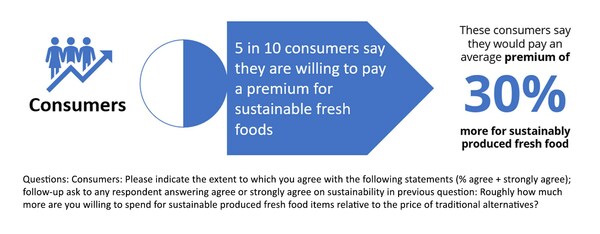

- Fresh food is green: 8 in 10 consumers surveyed believe fresh food is more sustainable than processed food. Half of consumers (5 in 10) are willing to pay a premium for sustainable fresh foods; on average, they’re willing to pay a premium of 30%.

- The majority of consumers surveyed (80%) prefer food retailers that source food from local farms, and more than half (57%) prefer to shop at a store that is meaningfully reducing their food waste. More than one-third (39%) want detailed data on how the fresh food they buy moves from farm to store, underscoring the importance of transparency.

- Even in a digital world, consumers surveyed are checking labels: one-quarter (25%) are more likely to check the label for information about their food, followed by an internet search at 20%. Further, two-thirds of consumers value packaging with labels because it helps them better understand their fresh food purchases.

- More than half (55%) of consumers surveyed use label data to determine which fresh food to purchase. Further, 89% say food safety is of the utmost importance.

“Consumers rely on grocers to help ensure their food is safe to eat. As a result, trust and transparency are key ingredients to driving sales of fresh food — around the products themselves as well as consumers’ personal health information. Those who invest in insights-driven personal data collection, food traceability, and transparency on the origin of food and the additives contained within can enhance consumer trust and drive business growth,” says James Cascone, sustainability, climate and equity leader, future of food leader, and advisory partner, Deloitte & Touche LLP.

“Fresh Food at the Intersection of Trust and Transparency” is based on a survey of 2,000 U.S. consumers conducted in July, as well as 100 U.S.-based grocery retail executives from organizations with over 10,000 employees.