Symphony RetailAI, a leading global provider of integrated AI-powered marketing, merchandising and supply chain solutions for FMCG retailers and manufacturers, today announced new insights from in-depth analysis of consumer shopping data, finding that across departments, price inflation is more common in fresh grocery categories. With inflation significantly higher in fresh compared to frozen and ambient or shelf-stable categories, price-sensitive shoppers are buying less in meat, poultry and dairy, while still prioritizing purchases of fresh produce.

In November, Symphony RetailAI released its “2021 Shopper Study: The Changing Customer Landscape,” a 12-month analysis of 2.2 billion shopper transactions across the company’s global customer base of grocery retailers. At the time of the report’s release, Symphony RetailAI noted that many categories important to price-driven customers were underperforming. The new consumer insights introduced today are an extension of the previous data analysis, looking more closely at those underperforming categories and how inflation is impacting sales of fresh items specifically.

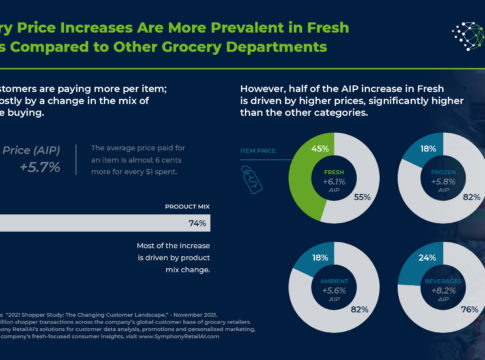

Symphony RetailAI found that inflationary price increases are much more prevalent in fresh than any other category in grocery.Across all departments, shoppers are spending more for their groceries, but a significantly larger portion of price increases for fresh items are due to inflation, not customer choice.Most of shoppers’ additional spend across categories is being driven by product mix – customers are buying more expensive products because of a change the retailer has made to the assortment, or because the customer has chosen to buy a more premium product. At the store level, only 26% of the additional consumer spend is being driven by increases in the base price.However, when analyzing fresh separately, Symphony RetailAI found that close to half of the average increase in price (45%) is driven by inflation, which is significantly more than observed in both frozen and ambient categories (both 18%) and in beverages (24%).

Additional takeaways from Symphony RetailAI’s analysis include the following:

- Because of inflation, traditional grocers are losing shoppers in the fresh categories of meat, poultry and dairy. When looking at shopper data and category bounce-back since COVID-19, meat, poultry and dairy specifically are underperforming with price-sensitive shoppers. In other words, prices are too high for many price-sensitive shoppers to buy. This means that traditional grocers have to be strategic with price and promotional strategies given the declining customer base for these categories.

- For every 10 items in a shopper’s basket, four are fresh products. Fresh is important to today’s grocery shopper, as evidenced by the fact that shoppers on average have 7 times more fresh items in their basket (43%) than items from the frozen category (6%). By comparison, the ambient or shelf-stable category makes up 29% of shoppers’ baskets.

- The fresh category is a frequency driver. In looking at monthly purchase frequency, fresh (24.8%) is purchased about as often as ambient products (22.5%), but twice as often as frozen (11.1%).

- Fresh is experiencing higher levels of customer growth than other grocery categories. Fresh categories saw 8% growth in shopper households over the course of one year, compared to 7% for ambient, shelf-stable products, 6% for beverages, and 5% growth for the frozen category.

“As evidenced by these insights, a limited view of aggregate shopper behavior across the store won’t lead to optimized decisions around price and promotional investments, especially with inflation impacting some categories more than others, as seen with meat, poultry and dairy,” said Charisse Jacques, SVP Global Customer-Centric Retail Services, Symphony RetailAI. “Retailers need a shopper-centric, AI-powered approach to differentiate their item and category strategies based on the importance of price or promotions to a given customer segment. If an item is extremely important to price-sensitive customers, the retailer can ensure the item is priced well to reverse any lost perception of value and further promoted to drive traffic and sales.”