Instacart has become a staple in many households, including my own. Whenever my wife needs some food items from stores like Sprouts, Publix & Costco, she will typically fire up her Instacart app and vwalla, within a few hours an Instacart angel will drop off our groceries. My parents would have killed for such a convenient service while raising our family in the 80’s and 90’s. Back in the day, if my mom needed sugar, eggs & cauliflower, she would have to leave the house and actually visit a physical grocery store. Oh the horror!

My wife is not alone with her adoption of Instacart as a way to shop for groceries. Millions of people turn to Instacart every day to purchase food and many other categories that the popular service offers. Consequently, Instacart has become a technology behemoth with a market cap of $13 Billion and plans to go IPO. For grocery chains and independent grocery stores, Instacart is also the go to platform for online and fulfillment, powering ecommerce for over 900 retailers and local grocers.

Everything dandy? Not quite; Instacart is failing your grocery business. From the many conversations we’ve had with executives and decision makers in the grocery space, the following is an outline on why many grocers are now looking to stand-up their own ecommerce capabilities and decouple their total dependence on Instacart.

From the customer perspective:

In a market research study conducted in Q4 2022, participating grocers were asked to rank the most important statements from a long list of business objectives. The highest ranking statement across all grocers we surveyed: Driving better consumer experiences is critical to our business. In a world where consumers have so many options at the touch of a finger, grocers know that a better customer experience is key to their business success. Despite the immediate gratification of quick grocery delivery via Instacart, consumers often lose out on multiple fronts.

Inflated Pricing:

It is no secret that many grocers mark up their pricing, often significantly, when selling via the Instacart marketplace. That’s because the traditional grocery space is faced with an already low profit margins and with the layering on of Instacart, which also needs to get compensated for each transaction, these grocers are compelled to raise their pricing. Remember that we are experiencing heavy inflation so the added Instacart cost passed on to the shoppers is a double blow. And while the Instacart inflated prices have been well documented in dozens of news outlets, including: Instacart Might Be Costing You More Than You Realize – NBC Los Angeles, Some Massachusetts grocery delivery customers stunned by Instacart price mark-ups (wcvb.com) , Marketplace investigation finds hidden markups and missed sales on Instacart | CBC.ca, Grocery stores charging Instacart customers higher rates (wmar2news.com) & Instacart vs in-store: Comparing grocery prices | kare11.com.

Many shoppers are unaware of these price hikes only to be shocked when they discover the harsh truth. For the record, not ALL grocers jack-up their Instacart pricing, but for the ones who do, it’s their customers who have to pay the price. Literally! Grocery chains try their utmost to be upfront of the price disparities, like this from Publix: Why are delivery prices different from the prices at my store? The increased price covers the costs of Instacart providing the overall service including shopping for the order. Publix is not attempting to profit from this service and is not collecting additional fees from customers to use it. Or this from H-E-B: Will the prices on Instacart be the same as in-store? A: Item prices may vary from in-store prices in your area. Prices may be higher than in-store prices to cover the cost of personal shopping.

Still- this assumes customers will read the grocers FAQ’s prior to shopping via Instacart. Without a doubt, many customers just shop their grocers directly via Instacart without reading the grocery chains’ “instruction manual”!

Disloyalty

Most, if not all, grocery stores run specials with discounts and other promotions such as buy one get one free. The goal with these incentives is to increase customer loyalty and sales. These promotions are available in-store and on a first-party ecommerce site, but will typically not be available to customers shopping via Instacart. That’s because Instacart is a separate ecosystem from in-house systems and promotions from one will not transfer to the other. The end result is that at a time when cost of food has skyrocketed, Instacart shoppers are missing out from available discounts.

For the record, a lot of the grocery chains are transparent about the reality that coupons and promotions are NOT available for customers via Instacart. For example from Sprout FAQ’s: The following are not available through the Instacart website: 72-Hour Sale and coupons of any type (including Sprouts digital coupons). However, this disclaimer will only be surfaced to consumers who bother to read the FAQ’s. But the shoppers who miss the fine print might feel hoodwinked- as evidenced in the news links above.

Eroding In-Store Experience

With the continued growth of Instacart in-store shoppers, grocers risk the possibility of inadvertently turning their physical stores experience into what sometimes feels like an automated warehouse. For many consumers, grocery shopping is an extremely personal and rewarding experience. You have the grocery list and the ability to peruse the aisles at your leisure amongst fellow shoppers. With the explosion of Instacart shoppers, there is now a new genre of co-shoppers; a bevvy of Instacart drivers hustling through the store trying to pick and pack orders as quickly as possible. This is especially true for the high-end gourmet focused grocery chains whose customers expect a bespoke store visit, but who now need to shop alongside Instacart drivers needing to grab and dash to make delivery times.

From the grocery retailer perspective:

Loss of adv revenue:

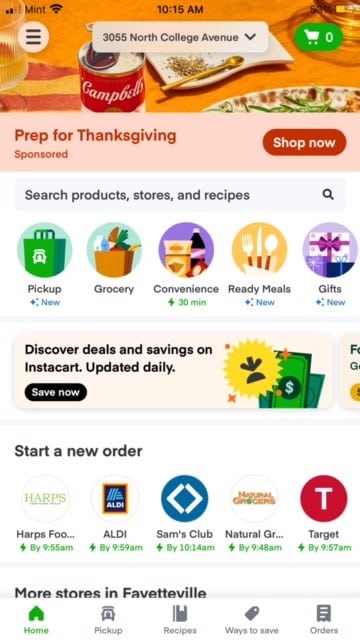

In 2020, Instacart launched an advertising unit for CPG’s. The ad network gives CPG’s the ability to advertise directly to shoppers. Advertising has also been the strongest growth driver to Instacart revenue growth as of late. The downside of CGP ads to grocers is like NielsonIQ states: Instacart eliminates retail partners from the equation! Also from NielsonIQ: If Instacart drives the majority of retail growth, manufacturers will continue to shift funds from in-store tactics to Instacart’s platform, and it is not a huge leap to imagine Instacart establishing direct-buying relationships with brands. And this from MarTech: The problem is that retail grocers are at risk of getting left out in this relationship. And as with any other single ad environment, it also creates the potential for a bidding war between competitors. Instacart wins in both scenarios.

Meet our Competitors:

When grocers direct their customers to shop via Instacart, they are effectively pointing their loyal patrons to their competition. I’ve experienced this time and time again. Case in point: a retailer directs a shopper to buy from them online via Instacart. The customer goes through the steps of creating an Instacart account. Now the customer just became an Instacart customer. When Instacart sends this customer a “Welcome to Instacart” email, with a link to shop, the grocers customer is taken to the Instacart marketplace, where they now have a BUNCH of other retailers to shop from.

Essentially, the retailer went from being the primary destination for the customer to now just another logo/banner in the Instacart marketplace. The cost of customer acquisition is not cheap, so why in the world would a retailer willingly aid and abet the transfer of an earned customer into the hands of the competition?

Replacement + Out of Stock Fees

Grocers have shared that whenever a customer interacts with an Instacart regarding out of stock and replacement issues, Instacart charges the grocer a flat fee of $10! That’s on top of the fees that Instacart is already charging the grocer. Furthermore, in this scenario, not only is this a poor experience for the shopper, but the grocer needs to eat the cost! This is a further erosion of precious and thin margins.

In conclusion, whilst Instacart is an incredible and quicker channel for grocers to grow their online sales, there are serious considerations at stake pertaining to the overall shopper experience and the long term ramifications to grocers. In parallel to the Instacart marketplace, grocers should explore and invest in their own first-party ecommerce capabilities.

Shmuel Tennenhaus is the Chief Marketing Officer at Stor.ai. Shmuel was formerly the VP Marketing of Big Fish Games and has 15+ years of success, building and managing teams of top talent in driving awareness, customer acquisition, and competitive positioning for global organizations and startups. He is also the host of the Jewish Comedy Podcast, The Shmuel Tennenhaus podcast available on itunes & spotify.