The Kroger Co. (NYSE: KR) today reported its second quarter 2020 results, provided a Restock Kroger progress update on the three-year transformation plan, and shared a COVID-19 response update.

Comments from Chairman and CEO Rodney McMullen

“Each day I’m inspired by the work our incredible associates do to bring to life our purpose, to Feed the Human Spirit. I am proud of our dedicated associates who are serving our customers when they need us most. Our top priority is to provide a safe environment for associates and customers and as the pandemic continues, we will continue to rise to meet the challenge.

Customers are at the center of everything we do and, as a result, we are growing market share. Kroger’s strong digital business is a key contributor to this growth, as the investments made to expand our digital ecosystem are resonating with customers. Our results continue to show that Kroger is a trusted brand and our customers choose to shop with us because they value the product quality and freshness, convenience, and digital offerings that we provide.

We delivered extremely strong results in the second quarter and expect to deliver consistently attractive total shareholder returns. We are more certain than ever that the strategic choices and investments made through Restock Kroger to execute against our competitive moats – Fresh, Our Brands, Personalization and Seamless – have positioned Kroger to meet the moment, especially as customers are rediscovering their passion for food at home.”

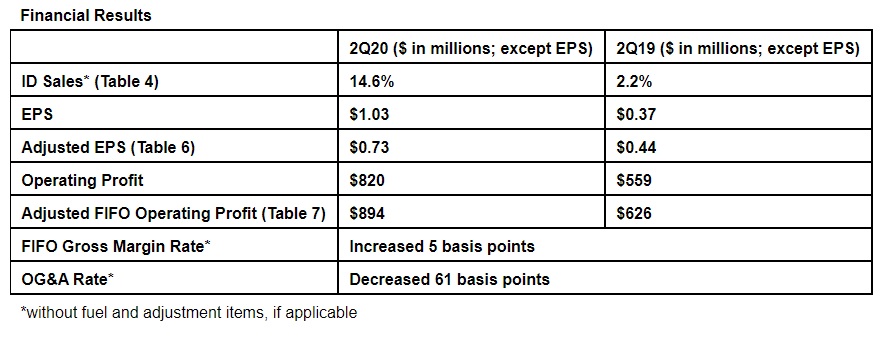

Total company sales were $30.5 billion in the second quarter, compared to $28.2 billion for the same period last year. Excluding fuel, sales grew 13.9%.

Gross margin was 22.8% of sales for the second quarter. The FIFO gross margin rate, excluding fuel, increased 5 basis points primarily driven by sourcing efficiencies, sales leverage and growth in alternative profit streams. This was partially offset by price investments and mix changes.

LIFO charge for the quarter was $23 million, compared to $30 million for the same period last year.

The Operating, General & Administrative rate decreased 61 basis points, excluding fuel and adjustment items, due to sales leverage and execution of Restock Kroger initiatives, partially offset by continued COVID-19 related investments to support and safeguard its associates, customers and communities.

Rent and depreciation excluding fuel decreased 27 basis points due to sales leverage.

Capital Allocation Strategy

Kroger’s capital allocation strategy is to use its adjusted free cash flow to invest in the business and drive profitable growth while also maintaining its current investment grade debt rating and returning capital to shareholders. The company actively balances the use of its adjusted free cash flow to achieve these goals.

Kroger’s net total debt to adjusted EBITDA ratio is 1.70, compared to 2.46 a year ago (Table 5). The company’s net total debt to adjusted EBITDA ratio target range is 2.30 to 2.50. Kroger held temporary cash investments of approximately $2.4 billion as of the end of the quarter, reflecting improved operating performance and significant improvement in working capital.

During the quarter, Kroger repurchased $211 million shares under its $1 billion board authorization announced on November 5, 2019. On September 11, 2020, the Board of Directors authorized a $1 billion share repurchase program, replacing the prior authorization.

Earlier this year, Kroger increased the dividend by 13 percent, marking the 14th consecutive year of dividend increases.

2020 Guidance

Comments from CFO Gary Millerchip

“As a result of our strong performance in the first half, the expectation of sustained trends in food at home consumption and confidence in our ability to execute against the Restock Kroger strategy, we are updating our full year 2020 guidance.

There are still many uncertainties and, as a result, we are providing a wider guidance range. For the full year 2020, we expect total identical sales without fuel to exceed 13% and we expect to achieve adjusted EPS growth of approximately 45% to 50%.

Relative to delivering on our total shareholder return growth targets as outlined at our November 2019 Investor Day, these factors also lead us to believe that our 2021 business results will be higher than we would have expected prior to the COVID-19 pandemic.”