The Kroger Co. (NYSE: KR) today reported its second quarter 2021 results and will update investors on how key initiatives are positioning the company for long-term sustainable growth.

Comments from Chairman and CEO Rodney McMullen –

“Our strategic focus on leading with fresh and accelerating with digital continues to build momentum across our business. Kroger’s seamless ecosystem is working. This was evident during the quarter as we saw customers seamlessly shift between channels, and we continued to see strong digital engagement. Customers are eating more food at home because it is more affordable, convenient, and healthier than other options.

“Our associates continue to support our customers and our communities through the pandemic by delivering a full, fresh, and friendly experience every day. We are committed to our environmental, social, and governance strategy to advance positive outcomes for people and our planet and create more resilient global systems, driven by our Zero Hunger | Zero Waste social and environmental impact plan.

“We are leveraging technology, innovation, and our competitive moats to deliver against the initiatives outlined at our 2021 investor day, and we remain confident in our ability to deliver total shareholder returns of 8% to 11% over time.”

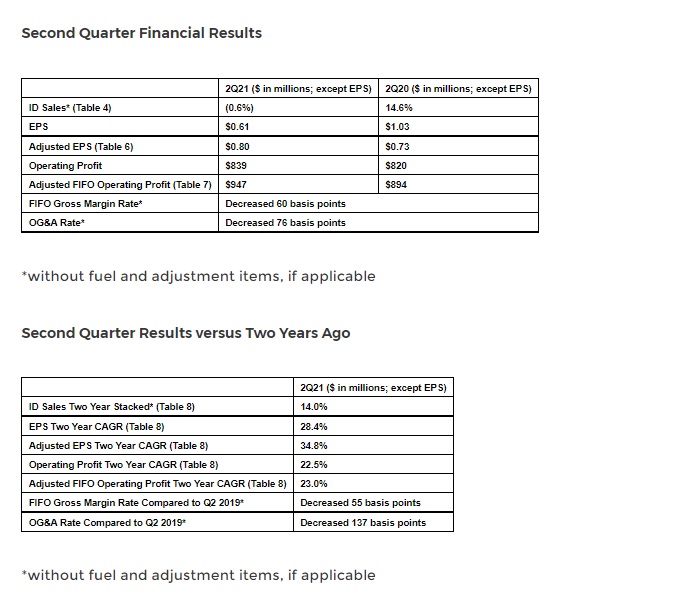

Total company sales were $31.7 billion in the second quarter, compared to $30.5 billion for the same period last year. Excluding fuel, sales decreased 0.4% compared to the same period last year.

Gross margin was 21.4% of sales for the second quarter. The FIFO gross margin rate, excluding fuel, decreased 60 basis points compared to the same period last year. This decrease primarily related to continued price investments, and higher shrink and supply chain costs, partially offset by sourcing benefits and growth in the alternative profit business.

The LIFO charge for the quarter was $47 million, compared to a LIFO charge of $23 million for the same period last year. This increase was primarily attributable to inflation in fresh categories.

The Operating, General & Administrative rate decreased 76 basis points, excluding fuel and adjustment items, which reflects decreased COVID-19 related costs and the execution of cost savings initiatives.

Capital Allocation Strategy

Kroger continues to generate strong free cash flow and remains committed to investing in the business to drive long-term sustainable net earnings growth, maintaining its current investment grade debt rating, and returning excess free cash flow to shareholders via share repurchase and a growing dividend over time.

Kroger’s net total debt to adjusted EBITDA ratio is 1.78, compared to 1.70 a year ago (Table 5). The company’s net total debt to adjusted EBITDA ratio target range is 2.30 to 2.50.

Earlier this quarter, Kroger increased the dividend by 17%, marking the 15th consecutive year of dividend increases. Additionally, in the quarter, Kroger repurchased $349 million shares and year-to-date, has repurchased $751 million shares. As of the end of the second quarter, $779 million remains on the board authorization announced on June 17, 2021.

2021 Guidance

Comments from CFO Gary Millerchip –

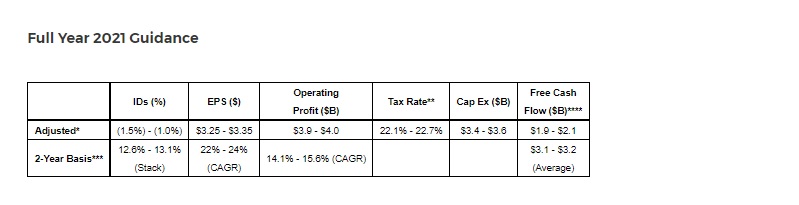

“Kroger’s strong execution resulted in identical sales above our internal expectations for the second quarter, and we continued to remove costs from the business. Driven by the momentum in our results and sustained food at home trends, we are raising our full-year guidance. We now expect our two-year identical sales stack to be in the range of 12.6% to 13.1%. We expect our adjusted net earnings per diluted share to be in the range of $3.25 to $3.35.

“We are emerging stronger through the pandemic and are confident in our ability to deliver sustainable earnings growth and total shareholder return.”

* Without adjusted items, if applicable; Identical sales is without fuel; Operating profit represents FIFO Operating Profit. Kroger is unable to provide a full reconciliation of the GAAP and non-GAAP measures used in 2021 guidance without unreasonable effort because it is not possible to predict certain of our adjustment items with a reasonable degree of certainty. This information is dependent upon future events and may be outside of our control and its unavailability could have a significant impact on 2021 GAAP financial results.

** This rate reflects typical tax adjustments and does not reflect changes to the rate from the completion of income tax audit examinations or changes in tax laws, which cannot be predicted.

*** Identical sales, without fuel, guidance for 2-year basis represents the sum of actual 2020 identical sales percentage and 2021 identical sales rate guidance. The 2-year basis guidance items denoted with CAGR represent the compounded annual growth rate utilizing 2019 as the base year. Average free cash flow is the average of actual 2020 free cash flow and 2021 guidance.

**** 2021 free cash flow guidance includes a $300M payment of deferred payroll taxes. This excludes planned payments related to the restructuring of multi-employer pension plans.

Second Quarter 2021 Highlights

Leading with Fresh

- Introduced brand icon, bringing together the Kroger Family of Companies under one unifying visual and reinforcing its brand promise: Fresh for Everyone

- Our Brands launched 142 new items during the quarter, including Big Pack items and further expansion of industry leading Simple Truth Plant Based line

- Announced collaboration with ghost kitchen partner Kitchen United to create new service that provides customers on-demand meal pickup and delivery from popular restaurants

- Announced inaugural Go Fresh & Local Supplier Accelerator cohort, launching innovative locally and regionally sourced products to stores across the country

- Introduced collaboration with KNAPP to modernize and expand the Great Lakes Distribution Center, driving efficiency improvements for regional store replenishment and faster delivery of fresh food for customers

Accelerating with Digital

- Introduced Kroger Delivery Savings Pass in Florida, offering customers unlimited delivery for $79 annually

- Launched sushi delivery pilot with DoorDash in three geographies

- Expanded pilot with Google Maps to improve grocery pickup experience for associates and customers

- Expanded to 2,239 Pickup locations and 2,546 Delivery locations, covering 98% of Kroger households

- Recognized by Computerworld magazine as one of the Top 100 Best Places to Work in IT for 2021, marking the fourth consecutive year Kroger has received the accolade

- Launched FEED app which provides associates easy access to company communication and resources

Associate Experience

- Increased Kroger Family of Companies’ average hourly wage to in excess of $16 and with comprehensive benefits, will be approaching $21 by the end of 2021

- Named to the Disability Equality Index’s 2020 “Best Places to Work for Disability Inclusion”

- Launched Fresh Start, a technology enabled, personalized, front-line associate training program to foster greater engagement and retention

- Selected as one of WayUp’s Top 100 Internship Programs for 2021

- Hosted a companywide live virtual event on mental health, featuring company leaders and other experts

Live Our Purpose

- Partnered with the Biden Administration in offering at-home, rapid COVID-19 tests at cost for 100 days

- Published 2021 ESG report highlighting new long-term ESG strategy and framework to benefit people and the planet, and to help create a more resilient, equitable food system for tomorrow

- Partnered with Lyft Healthcare, Inc. after concluding the successful #CommunityImmunity Giveaway in collaboration with the Biden Administration to increase vaccinations across the country

- Kroger Health has administered more than 6.7 million COVID-19 vaccine doses to date, supporting customers and associates

- Named Winsight Grocery’s Business of the Year for the company’s sustainability efforts throughout 2020

- Hosted The Wellness Experience, a virtual wellness platform and multi-day festival experience inspiring physical, emotional, and mental health

- Achieved $4.1 billion in diverse supplier spend in 2020, representing an increase of 21% versus prior year