Momentum Commerce, a modern digital retail consultancy, has announced a new analysis detailing a steady, months-long uptick in discounting activity across Amazon US. With inflationary pressures likely impacting holiday shopping budgets for consumers, this trend towards more pervasive discounting is a positive sign for Amazon to capture a greater share of holiday shopping revenue in the coming months.

The release of this latest analysis comes alongside the addition of Amazon Prime Early Access Sale (PEAS) data into the Momentum Commerce 2022 Amazon Prime Day Brand Scoreboard.

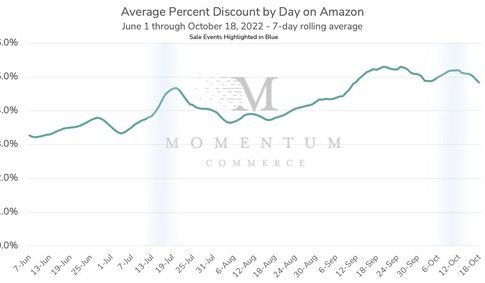

To conduct the discount analysis, Momentum Commerce utilized its vast repository of Amazon search data. Specifically, Momentum Commerce examined daily pricing and discount data for all products ranking in the top 10 overall placements across the top one million keywords on Amazon between June 1 and October 18, 2022. Digital goods including software, gift cards, and eBooks were not included.

The analysis shows a notable peak in average discount rate during Prime Day in July, which quickly reverted to pre-Prime Day levels. However, since mid-August, the average discount for a product sold on Amazon rose steadily, hitting above 5% regularly since mid-September. While discounts on certain products were certainly much larger during Prime Day, this latest average discount level surpasses the July sale event.

There are several potential key drivers behind this trend. Brands may be attempting to sell down older inventory in advance of the holiday season. Other brands perhaps rose prices earlier, and are now discounting slightly to catch consumer eyes on the search page and better position their products versus competitors.

For Amazon, this shift towards larger average discounts naturally makes the retail site a more attractive option for consumers as the holiday season approaches. This is particularly relevant in the context of inflation, as consumers are expected to trim their holiday budgets, or at the very least spread out that spending over a longer period of time. This latter prediction was a major reason behind Amazon spinning up its Prime Early Access Sale in October.

“Lower prices have always been at the forefront of Amazon’s value proposition to consumers, and this latest data shows how this trend is accelerating,” said John T Shea, CEO and Founder of Momentum Commerce. “There are going to be more consumers looking to stretch their holiday shopping dollars in 2022, and Amazon is catering to those needs. Helping our clients execute effectively in this environment, and knowing when and where to discount, advertise, and optimize, is where Momentum Commerce is putting its focus.”

For brands selling on Amazon, it’s important to note that discounting activity naturally varies significantly even within a single sub-category. The Momentum Commerce Prime Day Brand Scoreboard research tool provides a clear window into how hundreds of thousands of different brands across more than 1,500 categories approached both Amazon Prime Day and Amazon’s Prime Early Access Sale in 2022. The data includes whether a brand cut prices, increased their advertising investment, or largely sat tight during each sale event.

For both Prime Day and the Prime Early Access Sale, users can also dig one level deeper. Clicking on a displayed brand brings up sale event pricing changes for a selection of that brand’s top products within the selected category.

“As we went through the process of updating the Prime Day Scoreboard around October’s Prime Event, it was important to add in functionality to provide deeper, product-level insights,” said Ben Saufley, Director of Front-End Engineering at Momentum Commerce. “The resulting drill-downs make the dashboard experience that much richer for brands.”

Particularly as the holiday season approaches, this product-level data helps brands understand the nuances of a given competitor’s strategy around each sale event, and how they should adjust going forward. The larger discounting environment makes these nuanced decisions even more critical to best positioning a product within a brand’s current competitive landscape.