Kenshoo, a global leader in marketing technology has released The Kenshoo Q2 2020 Quarterly Trends Report, detailing Q2 digital advertising spending during the sustained COVID-19 pandemic. Across channels, product-specific shopping ads experienced robust spending growth even as overall social (-13%) and paid search (-9%) spending declined year-over-year (YoY).

Ecommerce Rules the Day

Consumers saw a lot more product ads across all channels, as impressions for the entire category of shoppable ads—which includes Search Shopping Campaigns, Social Dynamic Product Ads and the entire Ecommerce Ads channel—served more ads than during the holiday season. Impressions increased across the board:

● Search Shopping Campaigns: 100% YoY and 78% quarter-over-quarter (QoQ)

● Social Dynamic Product Ads: 87% YoY and 27% QoQ

● Ecommerce Ads: 92% YoY and 30% QoQ

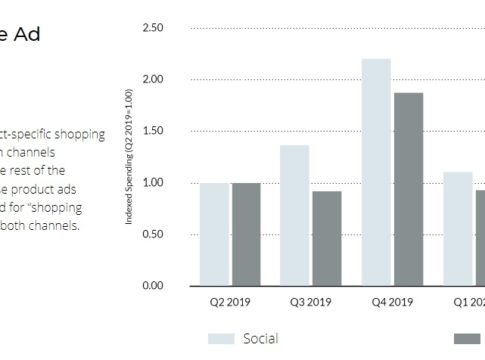

Spending growth on product-specific ads in the Social and Search channels drastically outperformed the rest of the channel in both cases. These shoppable ads comprised 41% of Q2 spend for “shopping and retail” advertisers across both channels.

The Rebound has Begun

While year-over-year spending on a monthly basis was down in each month of Q2 for the paid search and social channels, the gap between last year and this year narrowed each month April – June.

● Paid search: -13%, -9%, -6%

● Paid social: -16%, -12%, -10%

After the vast majority of Search spending in the Travel category disappeared in the second half of the first quarter, spending has increased every week of Q2 as the industry recovers.

“As anticipated, COVID-19 had a significant impact on digital advertising in Q2. As shelter-in-place orders pushed consumers to online shopping, online marketing budgets shifted to the ad types best suited to capture the increased demand. As a result, spending on shoppable ads increased both sequentially and year-over-year across digital performance channels,” said Chris Costello, senior director of marketing research for Kenshoo. “As consumers and advertisers both adapted to this new reality and adjusted strategies, the increased investment in shoppable ads fueled the first phase of the rebound, which has since expanded to other strategies and verticals, including travel.”

Methodology

Analysis is drawn from a population of nearly $7B in advertising spend, comprising over 3,000 advertiser and agency accounts across 40 vertical industries and over 150 countries running on the Kenshoo platform across Google, Microsoft, Baidu, Yandex, Yahoo! Japan, Verizon Media, Amazon, Walmart, Apple Search Ads, Pinterest, Snapchat, Facebook, Instagram and the Facebook Audience Network.

Except where noted in the report, only advertisers with 15 consecutive months of performance data are included. Some additional outliers have been excluded. Ad spending and pricing have been translated to USD at the time the spending was incurred.