NewStore, a modular, mobile-first omnichannel cloud platform for retail brands worldwide, today announced the launch of its 2023 Omnichannel Leadership Report. In its eighth edition, the company audited the omnichannel capabilities of 300 luxury, premium, and lifestyle retail brands in North America. The goal of the report is to assess the current state of retail and the industry’s progress toward digital transformation.

The research was conducted by a team of third-party mystery shoppers who were responsible for auditing each brand’s online, mobile app, and in-store shopping experiences to determine their omnichannel competence. Using a proprietary methodology, every retail brand was then assigned an overall rank and score as well as scores across each report category. In order to remove bias, brands on the NewStore platform are excluded from the study. From this process, NewStore identified the following brands as the 2023 Omnichannel Leaders:

- Hibbett Sports

- Shoe Carnival

- Bloomingdale’s

- Sephora

- Lululemon

These brands have shown strength in the face of the macro environmental forces that have upended the retail industry the past two years. While no company has been entirely immune to these challenges, this group has proven that the organizations that started their digital transformation journeys prior to the pandemic are able to achieve success now and into the future. This year’s report also found that the brands that didn’t make substantial changes 3 to 4 years ago have had to weather the storm with incremental innovations that ultimately slow the pace of their omnichannel evolution.

“Uncertainty is the new normal in retail, and the industry will only face more disruption. The 2023 Omnichannel Leadership Report should be a wake-up call for the brands that have not future-proofed their businesses,” said Stephan Schambach, Founder and CEO, NewStore. “Especially those that think multichannel is the same as omnichannel. Without an integrated approach to physical, digital, and mobile, brands will struggle to find long-term business profitability.”

Data Highlights:

- Online Experience

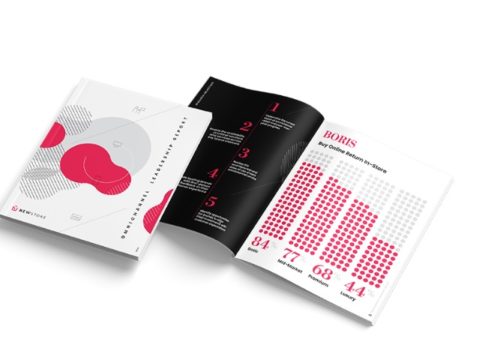

- 54% of brands offer order pickup in-store (BOPIS), and 72% of brands offer order return in-store (BORIS).

- 31% of websites show store inventory availability.

- Mobile Experience

- 33% of brands have a mobile shopping app.

- 89% of branded apps give access to loyalty information.

- Store Experience

- 32% of store associates use mobile devices, and 16% of stores offer customers mobile checkout.

- 54% of stores have endless aisle capabilities.

NewStore also segmented the 300 brands in this year’s report into four categories: Basic, Mid-market, Premium, and Luxury. The data showed omnichannel momentum and transformation in the Basic and Luxury segments, while Mid-market and Premium brands have stagnated. However, there is room for improvement across all groups because omnichannel success is about the long game. Today’s consumers demand seamless experiences at every level of retail, and short-term thinking puts future growth at risk.