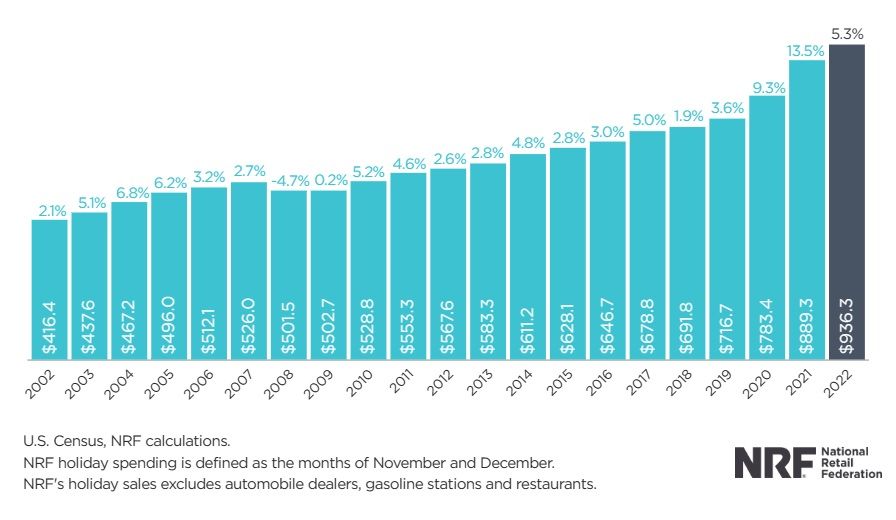

Retail sales during 2022’s November-December holiday season grew 5.3% over 2021 to $936.3 billion, falling short of the National Retail Federation’s forecast amid continuing inflation and high interest rates, NRF said today. While holiday growth was less than expected, sales for the year grew 7% over 2021 to $4.9 trillion, meeting NRF’s forecast of between 6% and 8% growth for the year.

“The last two years of retail sales have been unprecedented, and no one ever thought it was sustainable,” NRF President and CEO Matthew Shay said. “Nonetheless, we closed out 2022 with impressive annual retail sales and a respectable holiday season despite historic levels of inflation and interest rate hikes to cool the economy. Consumers shopped in record numbers and retailers delivered positive holiday experiences to inflation-wary consumers, offering great products at more promotional price levels to fit their stretched budgets. The fact that we saw retail sales growth on top of December’s 14% gain in 2022 shows the resilience of consumers and the creativity of retailers in driving consumption and economic activity while addressing high inflation and continued cost pressures.”

“We knew it could be touch-and-go for final holiday sales given early shopping in October that likely pulled some sales forward plus price pressures and cold, stormy weather,” NRF Chief Economist Jack Kleinhenz said. “The pace of spending was choppy, and consumers may have pulled back more than we had hoped, but these numbers show that they navigated a challenging, inflation-driven environment reasonably well. The bottom line is that consumers are still engaged and shopping despite everything happening around them.”

The holiday results top the $889.3 billion spent during the 2021 holiday season and compare with NRF’s forecast that 2022 holiday retail sales would increase between 6% and 8% over 2021 to between $942.6 billion and $960.4 billion. The 2022 growth compares with 4.9% average holiday sales growth over the previous 10 years.

NRF’s calculation of retail sales excludes automobile dealers, gasoline stations and restaurants to focus on core retail, and NRF defines the holiday season as November 1 through December 31.

The holiday total, which is not adjusted for inflation, includes online and other non-store sales, which were up 9.5% at $261.6 billion. NRF had forecast that the category would grow between 10% and 12% to between $262.8 billion and $267.6 billion. Online holiday sales were $238.9 billion in 2021.

For December alone, retail sales as defined by NRF were down 0.6% seasonally adjusted from November but up 5% unadjusted year over year. By comparison, sales were down 0.5% month over month in November after a surge of early holiday shopping in October but up 5.6% year over year. NRF’s numbers were also up 5.6% on a three-month moving average as of December.

NRF’s calculation is based on data from the U.S. Census Bureau, which said today that overall retail sales in December – including autos, gas and restaurants – were down 1.1% from November but up 6% year over year. In November, the Census numbers were down 1% month over month October but also up 6% year over year.

November-December holiday sales saw year-over-year gains in all but two of nine retail categories, led by online sales, grocery stores and general merchandise stores. Specifics from key sectors for the two months combined, all on an unadjusted year-over-year basis, include:

- Online and other non-store sales were up 9.5%.

- Grocery and beverage stores were up 7.8%.

- General merchandise stores were up 3.8%.

- Sporting goods stores were up 3.5%.

- Health and personal care stores were up 2.8%.

- Clothing and clothing accessory stores were up 2.2%.

- Building materials and garden supply stores were up 1.5%.

- Furniture and home furnishings stores were down 1.1%.

- Electronics and appliance stores were down 5.7%.