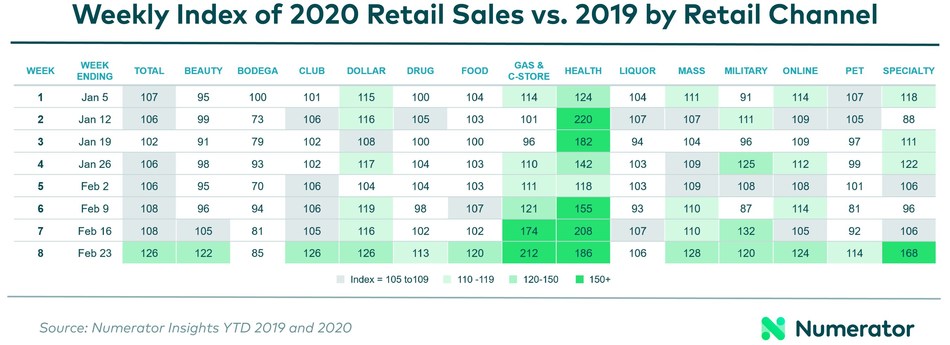

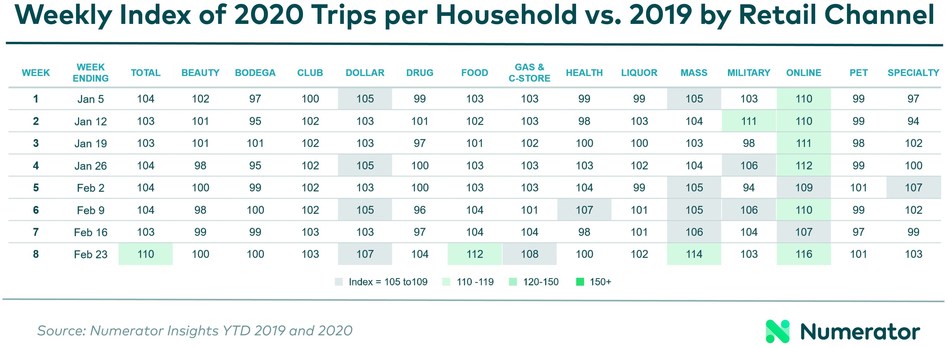

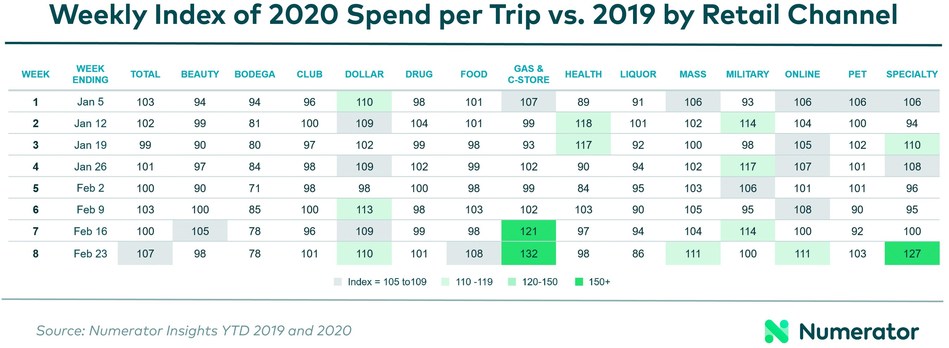

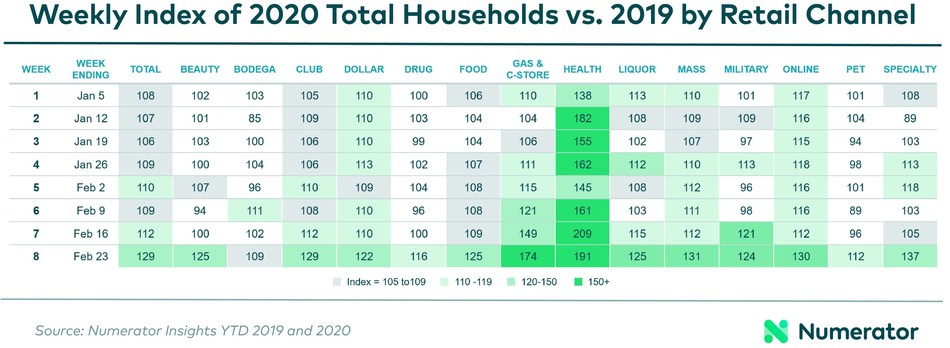

CHICAGO, March 13, 2020 /PRNewswire/ — Numerator, a data and tech company serving the market research space, will now publish a weekly Numerator Shopping Behavior Index tracker to provide needed visibility into consumer buying behavior shifts driven by COVID-19 (Coronavirus). The Numerator Shopping Behavior Index highlights shifts in U.S. consumer buying behavior versus a year ago across 14 retail channels on a week by week basis. It indicates significant spikes in consumer shopping across 12 of 14 retail channels as early as week 8, ending February 23 predominantly driven by increases in total households shopping in each channel (with total trips and average spend per trip generally flat).

The 14 channels include: beauty, bodega, club, dollar, drug, food, gas & convenience, health, liquor, mass, military, online, pet and specialty stores, covering the full omnichannel consumer buying experience. This means it reflects consumer purchases of fast moving consumer goods (FMCG) regardless of where they take place, in-store or online, in large or small format stores and more. This provides visibility into shifts in consumer buying across retail channels as they accelerate with the spread of COVID-19 due to increased demand and limited inventory.

The Numerator Shopping Behavior Index will be published weekly to help brands, retailers, analysts and others with much needed understanding of the impact of the virus on retail sales of fast moving consumer goods. It will initially provide a weekly index by retail channel for total sales, trips per household, average spend per trip and total households buying.

“This is an inflection point for the adoption of new consumer behaviors that will sustain beyond the outbreak period. Like SARS accelerated online buying in China, we expect COVID-19 to accelerate use of Click & Collect as well as shift even more consumers online in the U.S. and around the world,” said Eric Belcher, CEO, Numerator. “We have a very unique view of the market. While we normally restrict access to our clients, we thought it important to provide broader access to a foundational view of these important shifts through the duration of the outbreak.”

Numerator is the only company with a longitudinal view of how consumers buy across all retail channels. Other consumer panels stitch together consumer data from different sources which distorts the native switching behavior essential to understanding behavior, especially in periods where access to goods supersedes the consumer’s brand and retailer preference.

Given the importance of early understanding, the Numerator Shopping Behavior Index includes “a look forward” featuring data from the two most recent complete weeks (ending the Sunday prior to report publication). Near real-time data is essential to understanding consumer behavior in a time when inventory shortages and precautionary social-distancing are driving new buying behaviors. Because of this, the Numerator Shopping Behavior Index will publish weekly on Tuesdays and be available at www.numerator.com/coronavirus throughout the outbreak.

Initial insights from this first Numerator Shopping Behavior Index reflect Health Stores as first movers and a larger spike across retail channels in week 8. Selected channel specific insights follow. For context, the first U.S. travel restriction occurred during week 5 which also reflects Super Bowl buying behavior; the next travel ban expansion, CDC public health advisory and first U.S. death from COVID-19 occurred in week 9.

- Health Stores see the first spike in the Numerator Shopping Behavior Index as early as week 2, ending January 12. While unsurprising given that shoppers of Health stores prioritize preventive care, the spike is significant year over year and sustains. The number of households shopping health stores is nearly double the prior year by mid February.

- Gas & Convenience Stores is the next category to experience a spike, starting in week 6, ending February 9. This has likewise sustained. Spend per trip is the primary driver. Spend per trip was down in weeks 2-6, with indices rebounding to 101, 116 and 122 for weeks 6, 7 and 8.

- Dollar Stores start the year strong as the channel continues to enjoy organic growth. However, we see those strong indices in the high teens spike to an index of 126 in week 8, ending February 23.

- Online Sales also see year over year increase expected in this growing channel, although the indices may still be inflated due to stock up shopping. As with Dollar Stores, we see a further spike by week 8, popping to a 126, up more than 10 points from the next highest week. Notably, online shopping is largely being driven by incremental trips, spiking to a 116 index that same week.

- More on Week 8 ending February 23: While still prior to the CDC/WHO announcement, we see significant spikes in retail sales across 12 of 14 categories.

- Gas & Convenience stores, Health and Specialty stores showed the most significant gains at indices of 212, 186 and 168 respectively.

- Beauty, Club, Dollar, Food, Mass, Military and Online sales all indexed between 120 and 128.

- Drug Stores indexed at 113.

- Bodega Stores are down year over year.