Despite more interest in online shopping during the COVID-19 pandemic, eCommerce grocery saw only a slight uptick in sales from new users this year, according to the TABS Analytics Annual Food and Beverage Consumables Study. Overall, online grocery transactions increased 15% year-over-year, as existing buyers made more frequent purchases, and smaller eCommerce retailers saw massive surges in new buyers. Walmart was one of the beneficiaries of the shift to online, as it overtook Amazon in share of transactions for the first time.

The study also revealed that consumer packaged goods categories now lead the consumer sector thanks to significant increases in purchase frequency and average pricing. The majority of the 15 food and beverage “consumables” categories that TABS Analytics tracks saw meaningful gains.

“Given the focus on online shopping as the nation navigated stay-at-home orders and quarantines during the COVID-19 crisis, we expected online grocery to see a massive upswing this year. But, in reality, that was not the case,” said Dr. Kurt Jetta, executive chairman and founder of TABS Analytics. “Since eCommerce grocery has not succeeded in expanding the pool of buyers at a time when demand is expected to be greatest, it has become even clearer that this channel will never have the scale necessary to be profitable with the current business model. New, creative approaches are needed to address pricing and streamline the supply chain.”

TABS Analytics’ Eighth Annual Food and Beverage Study was conducted in August 2020, surveying 1,000 adults (18+) to uncover how consumer buying patterns within these categories are shaped by the promotions offered. There were 15 consumables categories analyzed: candy, carbonated beverages, cereal, cookies, crackers, frozen pizza, ice cream, juice (refrigerated), juice (shelf), frozen novelties, popcorn, salty snacks, sports drinks, water and yogurt.

Other findings in the study include:

- Rise of the small eCommerce grocery retailers: Companies, like Fresh Direct, NetGrocer and Peapod, saw a 140% increase in transactions year-over-year. Walmart remained stable at around a 30% share of transactions, while Amazon dropped to more than five points to 27% and Target declined to 11%. The significant drop by Amazon points to potential supply chain issues as they contended with the demand during the pandemic.

- eCommerce complementing, not cannibalizing, brick and mortar: Traditional stores are still reporting strong sales, indicating that they are not sacrificing sales to online channels. While most brick and mortar channels remained consistent year-over-year, value grocery chains, like Aldi, experienced a significant uptick in regular shoppers, while dollar stores and Costco experienced declines.

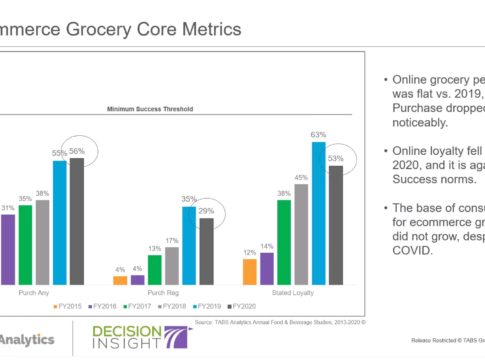

- Online purchase frequency still below long-term success threshold: Even though average transactions per buyer grew, regular purchasing dropped to 29% from 35%. Stated loyalty also saw a double-digit decline to 53%.

- Deals are more critical than ever before: Consumers are using deals more frequently now, despite retailers and manufacturers doing fewer promotions. There is a clear relationship between more usage of deals by heavy purchasers. The most important types of deals to consumers included everyday low price and larger sizes. Old school tactics, like circulars and free-standing inserts, saw a resurgence, but that is likely not sustainable.