Only 20% of American consumers ‘mostly’ or ‘completely’ trust Artificial Intelligence (AI) according to the fifth wave of the dunnhumby Consumer Trends Tracker (CTT) released today. Americans’ trust in AI is higher than other markets such as the UK, where the figure is 14%. The quarterly study – now completing its fifth quarter – found that the level of trust Americans have in AI is largely dependent on age. While younger consumers — under the age of 45 — have a higher level of trust in AI (31% ‘mostly’ or ‘completely’ trust AI), just 8% of those aged 55 and over ‘mostly’ or ‘completely’ trust AI.

The demographic groups that are more likely to trust AI are males (29%) versus females (14%), families with kids at home (29%), households earning more than $100k (37%) and those living in urban areas (32%) the CTT study found. In addition, respondents under 45 were the age group most enthusiastic about using AI based technology for budgeting, personalization, and sustainability which would thereby prove a genuine competitive advantage for grocers. The CTT is part of The dunnhumby Quarterly, an ongoing strategic market analysis of prominent retail themes. The fifth wave of this report is the first wave to address consumers’ feelings about AI. Two thousand consumers were surveyed for the fifth wave of the report.

“What many Americans may not realize is that they have been interacting with AI for years whether it is through Netflix recommending what they should watch next or a retailer serving up personalized offers based on consumers’ past purchases,” said Matt O’Grady, President of Americas for dunnhumby. “The potential of Artificial Intelligence in grocery is tremendous and has been at the foundation of our own data science here at dunnhumby for over 20 years. Although the trust in AI is far from widespread, grocers should bear in mind it only took ChatGPT two months to hit 100 million users, making it one of the fastest growing computer applications ever.”

Key findings from the study:

- The top five concerns respondents have about AI are 1) loss of jobs, 2) security and privacy, 3) loss of human touch, 4) technology ‘in the wrong hands’ and 5) misinformation.

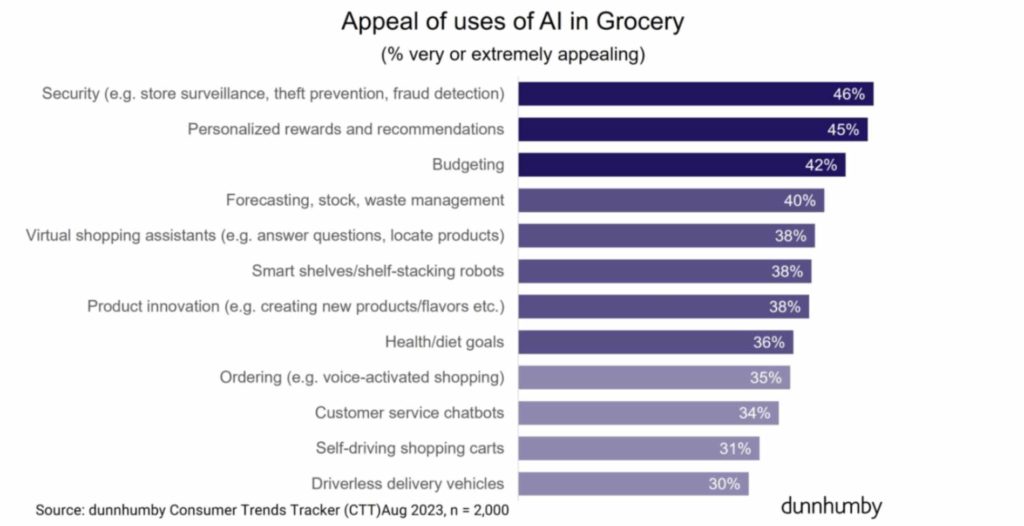

- Security (46%), personalized rewards and recommendations (45%), and budgeting (42%) are the three most popular grocery use cases for AI according to the survey respondents. For consumers under 45, a group that is struggling the most with food insecurity, the most appealing use of AI was for personalized rewards and recommendations (58%), followed by budgeting (57%).

- For older consumers, 55 and over —an age group that is otherwise distrusting or disinterested in AI— security (e.g. store surveillance, theft prevention, fraud detection) is the most appealing use (40%).

- When asked about the potential benefits of AI, respondents talked broadly about its potential to ‘help’ people (1).Respondents also ranked healthcare and medical (2), saving time (3), improvements and convenience (4), and research, knowledge and information (5) as potential benefits of AI.

- The increasing willingness of consumers to engage with loyalty programs signals an opportunity for grocers to use AI to deliver more advanced personalization. With 52% of consumersnow identifying themselves in order to redeem rewards, and 56% saying its very or extremely important that a retailer rewards them for shopping there signals the time is now right for retailers to step up their personalization efforts.

- Mounting food insecurity (30% of 18-34 year-olds ‘sometimes’ or ‘often’ do not have enough to eat), and fiscal conservatism, underpin the appeal of AI to help shoppers budget for groceries. Over half of younger consumers – under the age of 45 – shop around at different stores to find the best value (52%) and check prices online before/during a shop (51%).

- For consumers under 45, 51% reported the use of AI for forecasting, stock and waste management as very or extremely appealing. Reducing out-of-stocks and excess inventory is a positive use of AI, especially for the 56% of consumers that say it’s very or extremely important that a retailer cares about food waste and has sustainable products and packaging.

Methodology

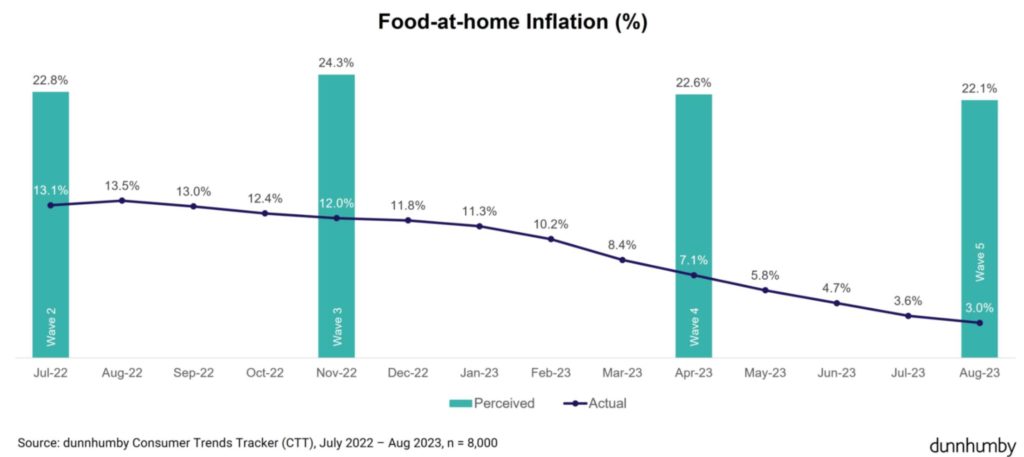

dunnhumby has interviewed 10,012 consumers, representative of the U.S. grocery shopper nationwide. The online interviews for Wave 1 were conducted in April 2022, Wave 2 in July 2022, Wave 3 in November 2022, Wave 4 in April 2023, and Wave 5 in August 2023. Approximately 2000 individuals were interviewed for each wave of the study.

The CTT study is designed to uncover shopper needs, perceptions and behavior over time, and to complement dunnhumby’s Retailer Preference Index which measures the strength of retailers’ customer value proposition.