People’s refocus on their local community in light of the COVID-19 pandemic will be long-term, bringing about the “decade of the home” and forcing retailers and consumer goods companies to tailor their products and services to drive a more local experience, according to findings of a recent global survey from Accenture (NYSE: ACN).

The continuing discomfort with public spaces and travel, coupled with growing financial fears amid widespread decline in household income, will continue to keep people mostly at home, according to the survey of more than 8,800 people in 20 countries. Findings of the survey are presented in two Accenture reports, one for the consumer goods industry and one for the retail industry.

Among the key findings:

- 69% of respondents expect to do most of their socializing over the next six months either in their home, a friend’s home or virtually;

- 53% of people who never worked from home previously now plan to work from home more often in the future;

- 56% of consumers said that the pandemic has caused them to shop in closer neighborhood stores, with 79% of those respondents saying they plan to continue to do so long-term;

- 56% of consumers said they’re buying more locally sourced products, with 84% of those saying they plan to continue to do so long-term;

- 50% of respondents cited financial security as one of their top three concerns over the next six months;

- 54% said they are shopping more cost-consciously and are likely to continue doing so — with consumers overall far more likely to have increased purchases of mid-range and budget brands and reduced purchases of premium brands since the pandemic began.

- At the same time, 12% of consumers said they have increased premium purchases, with 57% of those falling outside the high-income bracket.

“Home is now the new frontier — it’s become the workplace, the schoolroom, the place to try new hobbies, the place to socialize and a safe sanctuary — so companies must account for this reality,” said Oliver Wright, managing director and head of Accenture’s global Consumer Goods practice. “They’ll need to think beyond traditional tactics and be more creative, providing premium or virtual experiences and tailoring their portfolios to engage consumers. We’re already seeing this in the beverage and spirits industry, with Carlsberg launching its ‘adopt a keg’ campaign, and one London brewery offering a ‘pub in a box’ to local customers, hand-delivered by musicians who’ve had their tours cancelled.”

The report notes that some brands are reaping the rewards of adjusting their services to meet the shift in consumer demands by, for example, launching a new shopping experience to connect U.S. consumers with local businesses by allowing them to shop by region and by state. Yet it cautions that taking advantage of these opportunities will require ongoing and careful analysis to anticipate which of these new consumer behaviors will stick and then adapting their portfolios and financial models accordingly.

“Companies must boost their analytics capabilities to understand the pandemic’s impact on their businesses at a local level — tracking its effect on local businesses and employment and people’s level of comfort in returning to pre-COVID activities,” said Jill Standish, senior managing director at Accenture and head of its Retail practice globally. “In addition to making consumers comfortable re-engaging outside the home through strict health and safety measures, retailers should carefully assess their physical assets — i.e., which stores to keep open and what inventory to stock, taking into account, for example, whether and when schools reopen. They might also experiment with temporary spaces, such as pop-ups in local communities.”

The latest research supports Accenture’s previous findings that the changes in consumer behavior, such as the dramatic rise in e-commerce since the start of the pandemic, are likely to remain or accelerate further. For instance, the proportion of online purchases by infrequent e-commerce users — i.e., those who used online channels for less than 25% of purchases prior to the outbreak — has increased 170% since the outbreak.

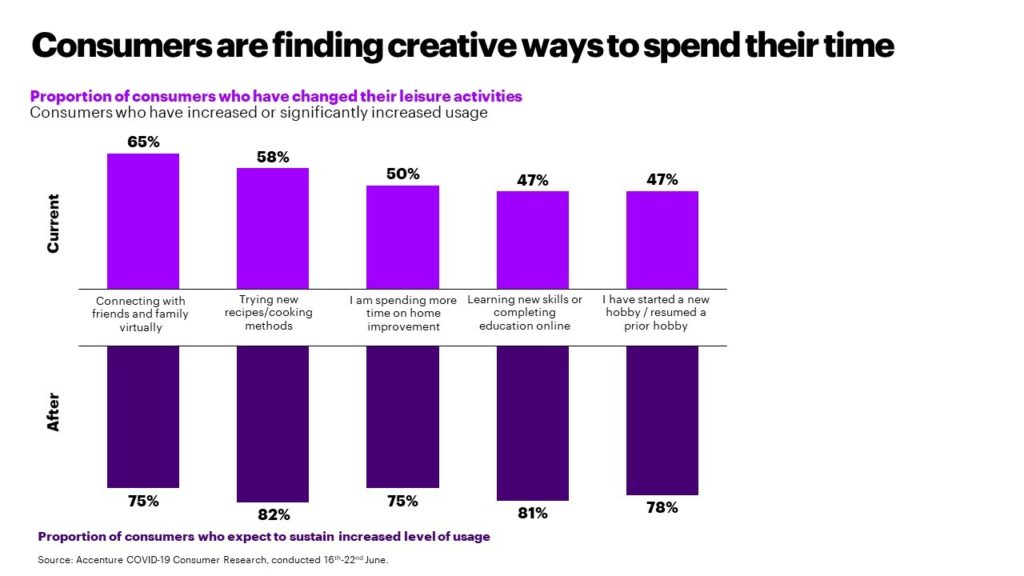

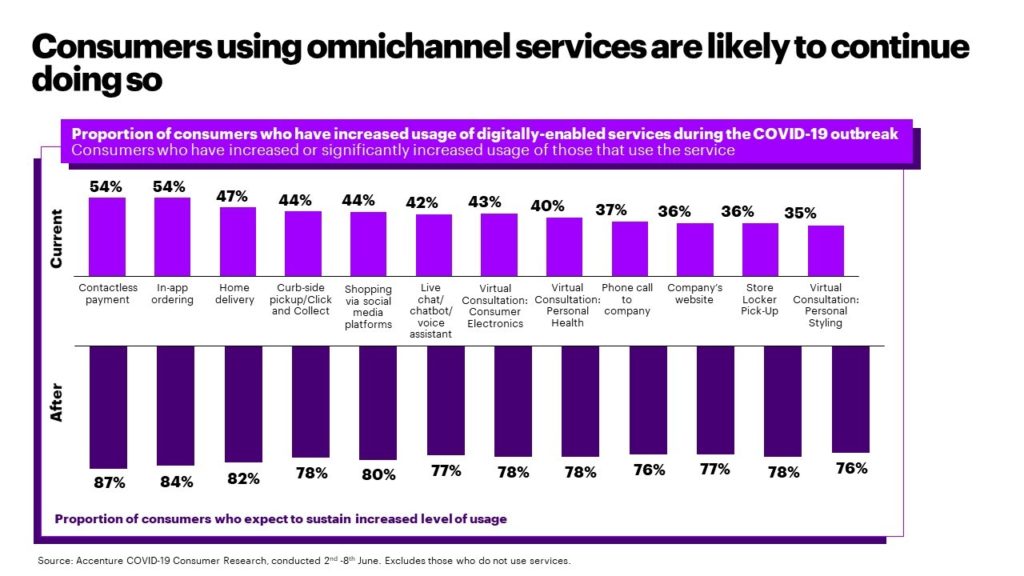

Further, the survey found that consumers who have increased usage of digitally enabled services (e.g., contactless payment, in-app ordering and curb-side pickup) and have turned to digital customer service channels (e.g., website or mobile app, mobile messaging with virtual agent, or online chat with a chatbot) expect to sustain an increased level of usage.