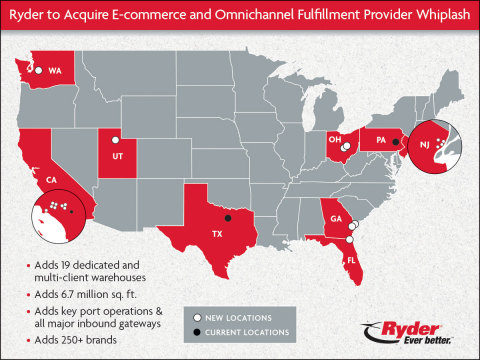

Ryder System, Inc. (NYSE: R), a leader in supply chain, dedicated transportation, and fleet management solutions, announces it has entered into a definitive agreement to acquire Whiplash, a leading national provider of omnichannel fulfillment and logistics services, for approximately $480 million in cash. Based in City of Industry, Calif., Whiplash provides scalable e-commerce and omnichannel fulfillment solutions to an impressive roster of more than 250 brands. The company’s 19 dedicated and multi-client warehouses total nearly seven million square feet and provide access to key port operations and gateway markets.

The transaction is accretive to shareholders and is expected to add approximately $480 million in gross revenue to Ryder’s supply chain solutions business segment in 2022 and provide incremental growth to Ryder’s earnings in 2022. Ryder and Whiplash expect to complete the transaction in late December 2021 or early January 2022, subject to satisfaction of antitrust approvals and customary closing conditions.

Ryder expects to integrate Whiplash’s facilities, operations, technology, and warehouse automation and robotics into its e-commerce fulfillment solution within the supply chain solutions business unit. (Photo: Business Wire)

“The acquisition of Whiplash is consistent with our strategy to accelerate growth in our higher-return supply chain business. It also expands our e-commerce and omnichannel fulfillment network and reflects our continued focus on technology and innovation,” says Robert Sanchez, chairman and chief executive officer for Ryder. “Whiplash’s best-in-class e-commerce platform and key geographic strongholds—coupled with Ryder’s industry-leading transportation logistics solutions, including our robust Ryder Last Mile delivery network for big-and-bulky goods—positions us to deliver incredible value for our customers who are looking for more advanced e-fulfillment solutions in today’s ever-changing landscape.”

Ryder expects to integrate Whiplash’s facilities, operations, technology, and warehouse automation and robotics into its e-commerce fulfillment solution within the supply chain solutions business unit. Additionally, Ryder plans to retain Whiplash’s executive team and workforce, with their proven operational expertise, to execute the growth and customer solutions in this segment.

“With e-commerce sales continuing to hit record levels and omnichannel retailing becoming mainstream, we’re seeing a significant uptick in brands looking for more dynamic fulfillment services,” says Steve Sensing, president of global supply chain solutions for Ryder. “Whiplash has built a proven model that meets today’s consumers where, when, and how they choose to engage with brands—whether that’s on-line from a mobile device or laptop, in-store, or a combination. We expect that our combined customers will benefit from that additional flexibility as well as Ryder’s vast nationwide network, extensive technology suite, best-in-class warehouse management practices, and end-to-end transportation logistics solutions.”

The acquisition will add to Ryder’s current e-commerce fulfillment network with new facilities in Chino, Calif; City of Industry, Calif.; Long Beach, Calif.; Jacksonville, Fla.; Savannah, Ga.; Newark, N.J.; Secaucus, N.J.; Clifton, N.J.; Columbus, Ohio; Salt Lake City, Utah; and Sumner, Wash. Additionally, the acquisition strengthens Ryder’s presence in key port operations, providing four-corner coverage of all major U.S. inbound gateways via Seattle/Tacoma, New York/New Jersey, Savannah, and Long Beach.

With the expanded footprint following the acquisition, Ryder’s e-commerce and omnichannel fulfillment solution is expected to be able to deliver to 100% of the U.S. within two days and 60% of the U.S. within one day.

“This announcement signals a new accelerated phase of growth for Whiplash that will benefit our current customers and dramatically enhance our ability to scale and deliver innovation for digitally-native brands and omnichannel retailers,” says Jeff Wolpov, chief executive officer of Whiplash. “Ryder’s supply chain expertise, facility network, and last-mile transportation solutions are a perfect complement to the Whiplash e-commerce platform, and we’re excited to be part of the Ryder team.”

Wofford Advisors LLC acted as lead strategic advisor to Ryder and Blank Rome LLP acted as legal counsel on the transaction. J.P. Morgan Securities LLC acted as exclusive financial advisor and Paul Hastings LLP served as legal counsel to Whiplash.