US retailers are struggling to shift months’ worth of stock and maintain profitability as the average order value online from consumers dropped last week to its lowest level since the start of the pandemic, data from ecommerce expert Emarsys shows today.

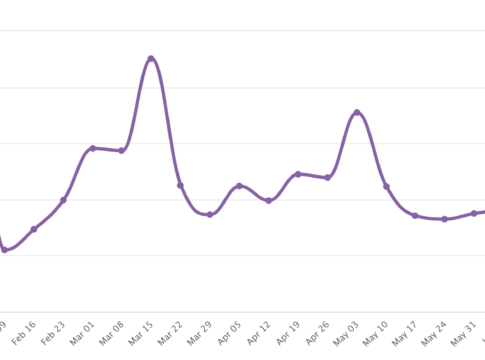

The average value of online orders made by US consumers shrank by 23% year on year in the week leading up to July 12 — the worst contraction of this particular indicator of consumer confidence since the beginning of January this year:

To make matters worse, revenue growth for retailers hit just 64% at the beginning of July, the slowest growth since the height of global lockdown in April.

These consumer trends are having a huge impact on retailers’ ability to shift stock, which in turn has significant business implications as Alex Timlin, senior vice president of verticals at Emarsys, explains: “US retailers have a tough choice right now. Either they discount products en masse to shift them, which directly affects profitability, or they keep their stock until this time next year, which means missing out on potential sales in the short term and having out-of-date stock next year.”

“Many retailers are opting for the latter option because of the costs involved of online retail. Retailers make most of their profit from shifting stock in store, whether it’s through consumers shopping in person or using click-and-collect online. However, the majority of online retail often involves a complex supply chain of distribution centres and delivery networks covering thousands of square miles, which means selling to consumers online can be up to 90% more expensive. This situation makes discounting online very difficult, and so brands are left with no choice but to hold on to stock for now.”

These most recent online customer trends were identified by Covid-19 Commerce Insight, a joint project between leading customer engagement platform provider Emarsys and data analytics provider GoodData showing the impact the impact of Covid-19 on consumer confidence.

Covid-19 Commerce insight draws on more than a billion engagements and 400 million transactions in 120 countries, providing a global and regional picture of ecommerce activity and trends — a key indicator of overall economic conditions in these unprecedented times.

Key insights from Covid-19 Commerce Insight include how the pandemic is affecting the number of online consumer transactions, order numbers, the average order value, types of items purchased and more — in any industry and region in the world — in context of the extraordinary measures taken by governments globally.